-

Consulting

The Grant Thornton FS Consulting team have a wealth of experience across a wide range of issues. From banks to insurance companies, the FS Consulting team have branched into all areas of Financial Services. Our FS Consulting team can help you with an array of issues, and guide you through the journey.

-

Corporate Finance

Grant Thornton’s Corporate Finance team has built up a vast range of experience providing a range of transaction, valuation, deal advisory and restructuring services to clients for the past two decades.

-

Financial Accounting and Advisory Services (FAAS)

Our team of experts here at Grant Thornton is committed to providing best-in-class solutions to help our clients effectively overcome the hurdles associated with complex regulatory compliance requirements, especially when entering new markets.

-

Financial Crime (AML)

Protect your business from financial crime with expert AML solutions.

-

Forensic Accounting

Resolve disputes, uncover fraud and protect your business with expert forensic accounting, investigations and digital forensics support.

-

Internal Audit & Control Assurance

Strengthen governance, enhance controls, and ensure compliance with expert internal audit and assurance services.

-

IT Risk Assurance and Advisory

Ensure IT compliance, mitigate risks, and enhance governance with expert IT risk assurance and advisory services.

-

Risk Advisory

Our Risk Advisory team delivers innovative solutions and strategic insights for the Financial Services sector, addressing disruptive forces, regulatory changes, and emerging trends to enhance risk management and foster competitive advantage.

-

Sustainability Desk

Grant Thornton’s team of experts provides a wide range of sustainability solutions, combining our knowledge of sustainability with our deep experience in providing professional services.

When you have a dependence on third parties, you need a dedicated approach to third-party risk management (TPRM). TPRM programs manage the risks that can be introduced through third-party relationships, including brand and reputation risks through data leaks, disruptions to customer service, supply chain risks and even financial fraud. When your service provider uses downstream entities for extended service and support, you also need to consider the risks from a fourth party (a subcontractor to your third party).

The realities of third-party risks are important in the boardroom. The board’s oversight of the risk function is important to making sure all bases of the risk profile are covered. That’s especially true for private companies, where risks might be greater due to less regulatory mandated oversight.

How can you find the capacity and skills for additional TPRM when you form a significant new third-party relationship?

Internal audit (IA) can play a critical role in responding to this risk environment, and IA is keenly aware of third-party risk. In a recent survey from the Institute for Internal Auditors [PDF - 8.9mb], third-party risk was identified as one of the top three areas of concern. The internal audit team brings an independent perspective to process, risks and controls, along with experience in reporting to senior leadership, all of which can be key to designing your TPRM program.

Trends in TPRM

As you launch or improve your TPRM program, consider starting with an awareness of market trends. Some of the current trends include:

As organisations become more technologically dependent, they expand their use of third parties, particularly in the IT area. Software is increasingly cloud-based, and the dwindling number of on-premise services are usually hosted by a third party.

Forrester research predicted that about 60% of security incidents this year will be the result of issues with third parties. Risks that relate to cybersecurity and data protection should be monitored.

Processes and controls should be in place to manage the risks when a cybersecurity breach happens in a third party — to assess the criticality, the impact to your organization or potentially even to your customers.

In companies that take an enterprise-wide view of risk, the responsibility for risk management is less siloed. That helps all departments work together within a common framework.

As the regulatory environment evolves, organizations must manage their own compliance and include the performance of third-party partners in their compliance evaluations.

Environmental, Social and Governance (ESG) is becoming increasingly visible in non-financial reporting and public communications. Organizations are accountable for their partners’ performance as well as their own.

TPRM automation is becoming essential, to limit the time spent on administration and repetitive tasks, shifting the focus to value.

IA in evaluating TPRM readiness

Internal audit can help you provide a TPRM readiness assessment, which typically includes three phases:

- Planning and initiation:

IA can help evaluate the effectiveness of a TPRM program by selecting a framework that provides a comprehensive view of the TPRM program lifecycle and in defining the in-scope operating environment. - TPRM program assessment:

IA can help assess the governance and operating model, including TPRM program lifecycle to evaluate controls and to identify process gaps and opportunities for improvement. - Reporting:

IA can help prioritize any remediation needs with key stakeholders, develop a comprehensive program assessment and compile a report for board and executive leadership.

IA in assessing TPRM frameworks

There are essentially three TPRM program governance models to consider for your organization: centralized, federated, and de-centralized. The internal audit team can help determine which will work best in the structure of your organization, as each model comes with its own unique benefits and challenges to weigh.

Since internal auditors are independent and objective, they are often called upon to wear a consultant hat instead of an auditor hat. Their risk-based perspective can help determine the maturity level of the existing third-party risk management process, and what governance model and operating framework is the most appropriate. Their knowledge can help determine the appropriate controls for each relationship. IA knows the right questions to help ensure your organization gets the information it needs to select, monitor and manage third-party relationships.

For example, if a third party has access to the company’s data, you might need to ask:

- Is there a defined data classification policy? Does the policy clearly define how certain classes of data should be secured?

- Does the third party have privileged access or elevated privileges? If so, does it log and perform reviews of the activities it performs?

- Does the third party always have carte blanche access, or does it use a limited portal or channel?

- Is the third party being monitored by your organization?

IA can also ask important questions in each phase of the TPRM program. For instance, in contracts and negotiation, IA can make sure you include a “right to audit” clause so that your organization can perform its own investigation if necessary. It’s also important to assess how the third party might be able to grow with your organization in the future.

IA in every phase of TPRM program lifecycle

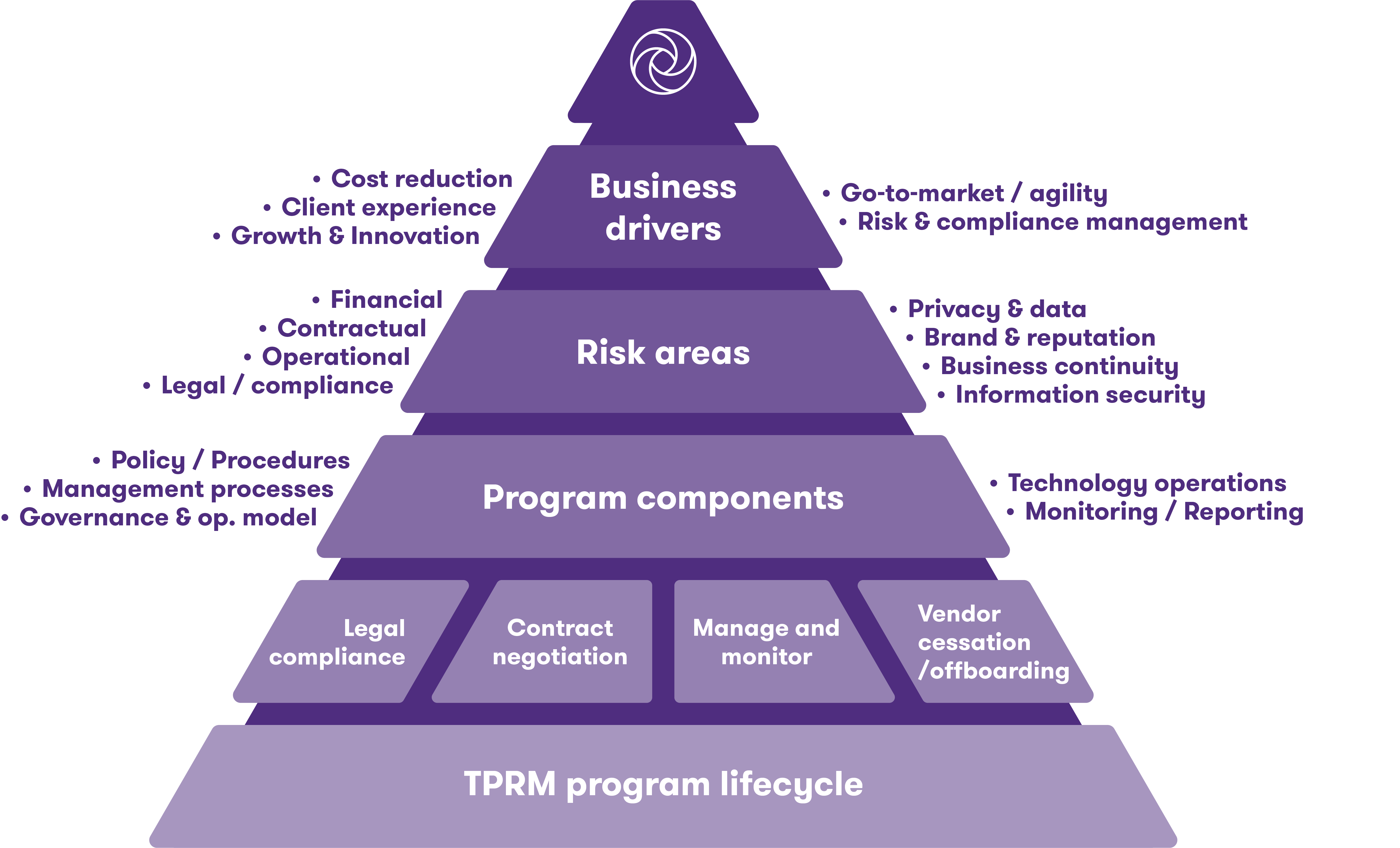

A TPRM program lifecycle is designed to maximize the business goals while minimizing the risks that arise from external relationships. The goals of the program should be to increase awareness of third-party management roles and responsibilities; establish coordination of third-party relationships; provide a clear understanding of risk; and deliver standardized risk classification and rating levels. The program lifecycle comprises four phases, and IA can play an important role in each one:

- Profiling and selection (due diligence):

IA can evaluate the profiling and selection process, along with adoption and consistency. IA can also assess the risk assessment process, including risk acceptance and exception. The exception process should depend on the risk level of the third party or vendor, require approval from designated authorities and identify compensating controls. - Contract negotiation:

IA can evaluate the entry criteria before a contract is negotiated, to determine if it was evaluated using appropriate mechanisms. A third party or vendor should only be on-boarded after the contractual obligations are met — or for exceptions, after risk mitigation strategies are in place to ensure compensating controls are implemented in a timely manner. - Managing and monitoring:

IA can review guiding principles for risk assessment and monitoring review frequency. These should be based on the nature of service provided and the risk exposure that the company faces when contracting with the third party or vendor. - Termination/off-boarding:

IA can review the process for off-boarding to ensure there is a comprehensive checklist, and appropriate controls and communications in situ.

Outlined below is a typical TPRM program framework, illustrating the business drivers, risk areas and program components over the four phases of the TPRM program lifecycle:

Third party risk management program framework

Third-party services can often help lower costs, improve efficiency, add skills, boost capacity and offer other benefits, but those benefits come with risks that should be managed.

That’s why it’s essential to have a comprehensive and well-designed TPRM program to provide ongoing control monitoring and risk oversight. Internal audit is a valuable partner in addressing these risks, from evaluating the TPRM program governance model to assessing the process, risks and controls through the TPRM program lifecycle. All of this work plays an important role in managing the risks that arise from third party relationships.